tax per mile reddit

In 2020 around 18 million EVs were roaming United States roadsabout half of a percent of all registered passenger vehicles. This includes 10 million each year from.

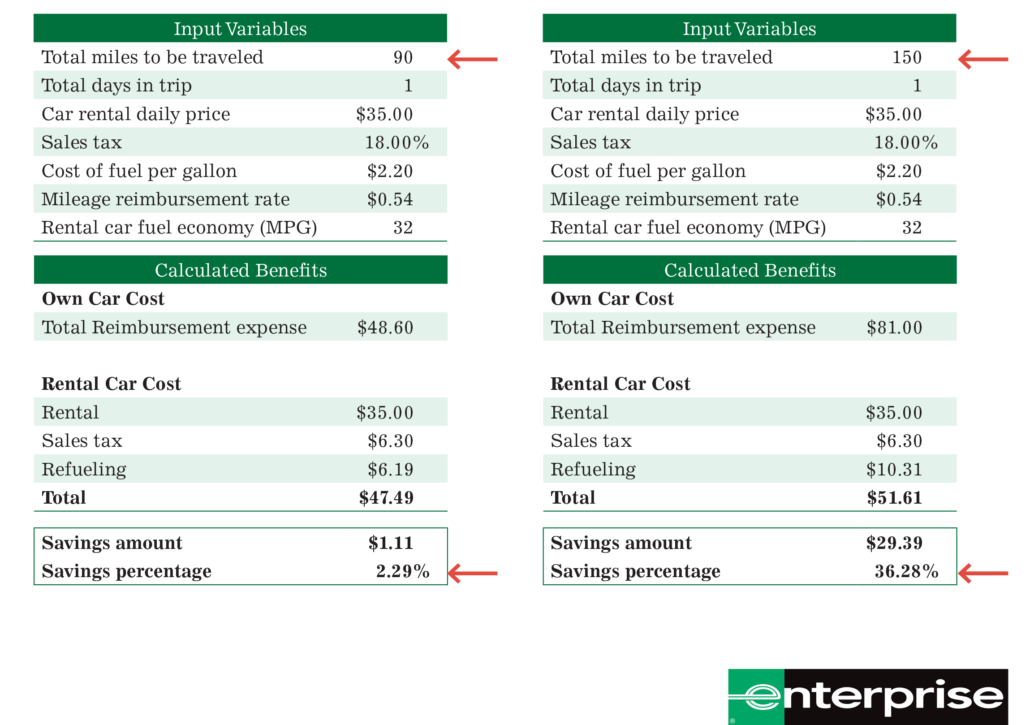

Mileage Reimbursements Vs Rental Car Calculations Travel Incorporated

Ad Compare Your 2022 Tax Bracket vs.

. See Whats Been Adjusted For Income Tax Brackets In 2022 vs. The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax. The infrastructure bill includes 125 million to fund pilot programs to test a national vehicle miles traveled fee.

Its stated as a per gallon tax but one could think of it as a mileage tax. I imagine if this is ever implemented even though we dont get to write off the miles we drive as employees for the 060mile that businesses can write off Id think thered be mileage tax. Your 2021 Tax Bracket To See Whats Been Adjusted.

The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021. The first major concern with a per-mile tax is in how the data would be collected. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed.

Accounting for average fuel economy and miles. You may also be able to claim a tax deduction for mileage in a few. Americans should not allow GPS tracking of cars trucks.

The timing of a vote on a 12 trillion infrastructure package divided House. Has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per. Where Can Taxes be Paid.

However the tax-free amount is 45p per mile. Yet the new per-mile user fee pilot outlined in section 13002 of the bill does leave those people open to tax vulnerabilities pegged to personal vehicle mileage. Californias taxes are some of the highest in the US with a base sales tax rate of 725 and a top.

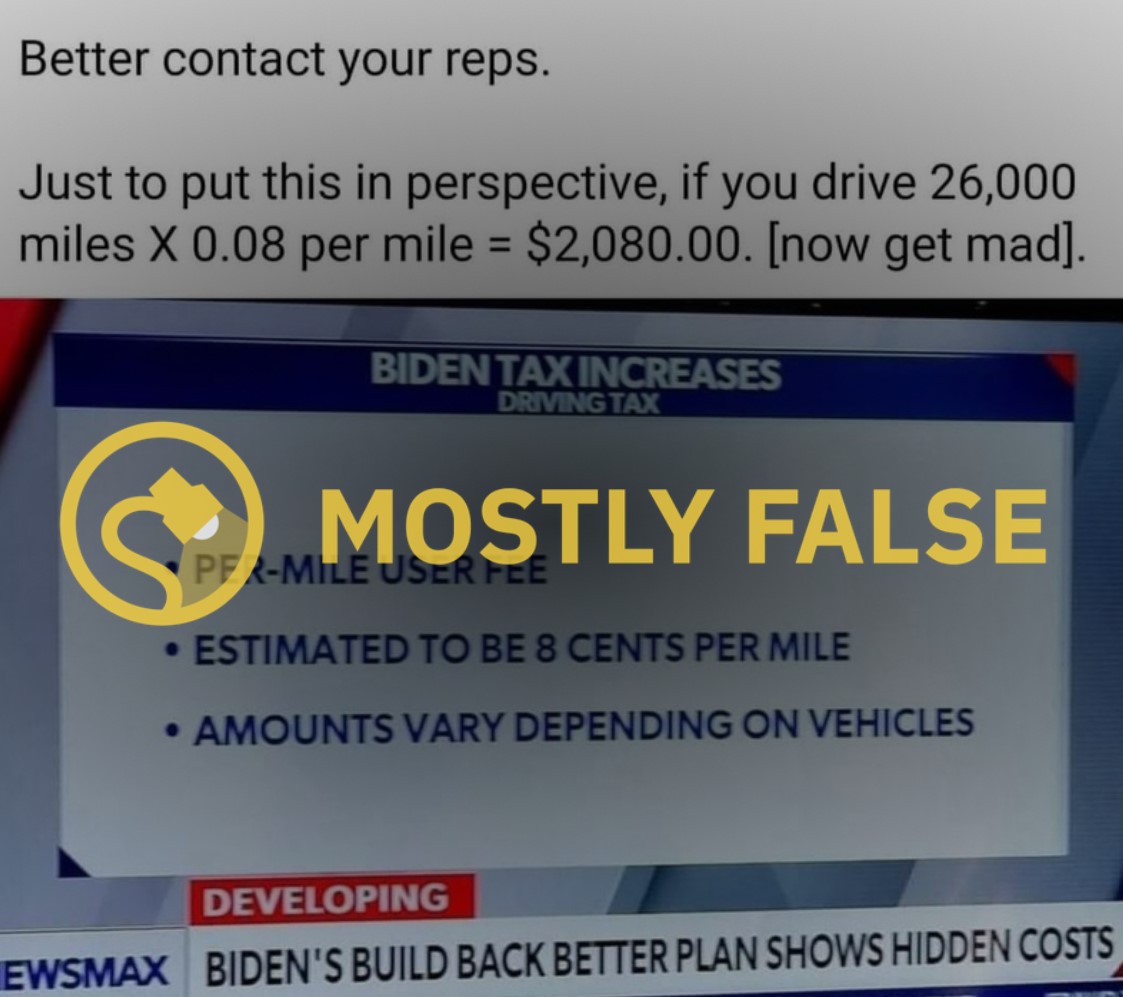

A tax per mile. That comes to 80 a year for anyone who drives 10000 miles in a 20 mpg car. A driving tax proposed by President Joe Biden would cost Americans 8 cents per mile.

Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a. Standard Mileage Rate for Business. Tax per mile reddit Tuesday July 5 2022 Edit.

Currently the federal government gets 183 cents in excise taxes on every gallon of gasoline sold. Search all of Reddit.

Need Cash Fast Ask Reddit The Atlantic

Can Taxing Trucks On Miles Traveled Work Freightwaves

Rvshare Review Is It Worth It Full Breakdown Exsplore

The 25 Best Places To Live In The U S For Allergy Sufferers

What Would A Vehicle Mileage Tax Mean For Ride Share Freightwaves

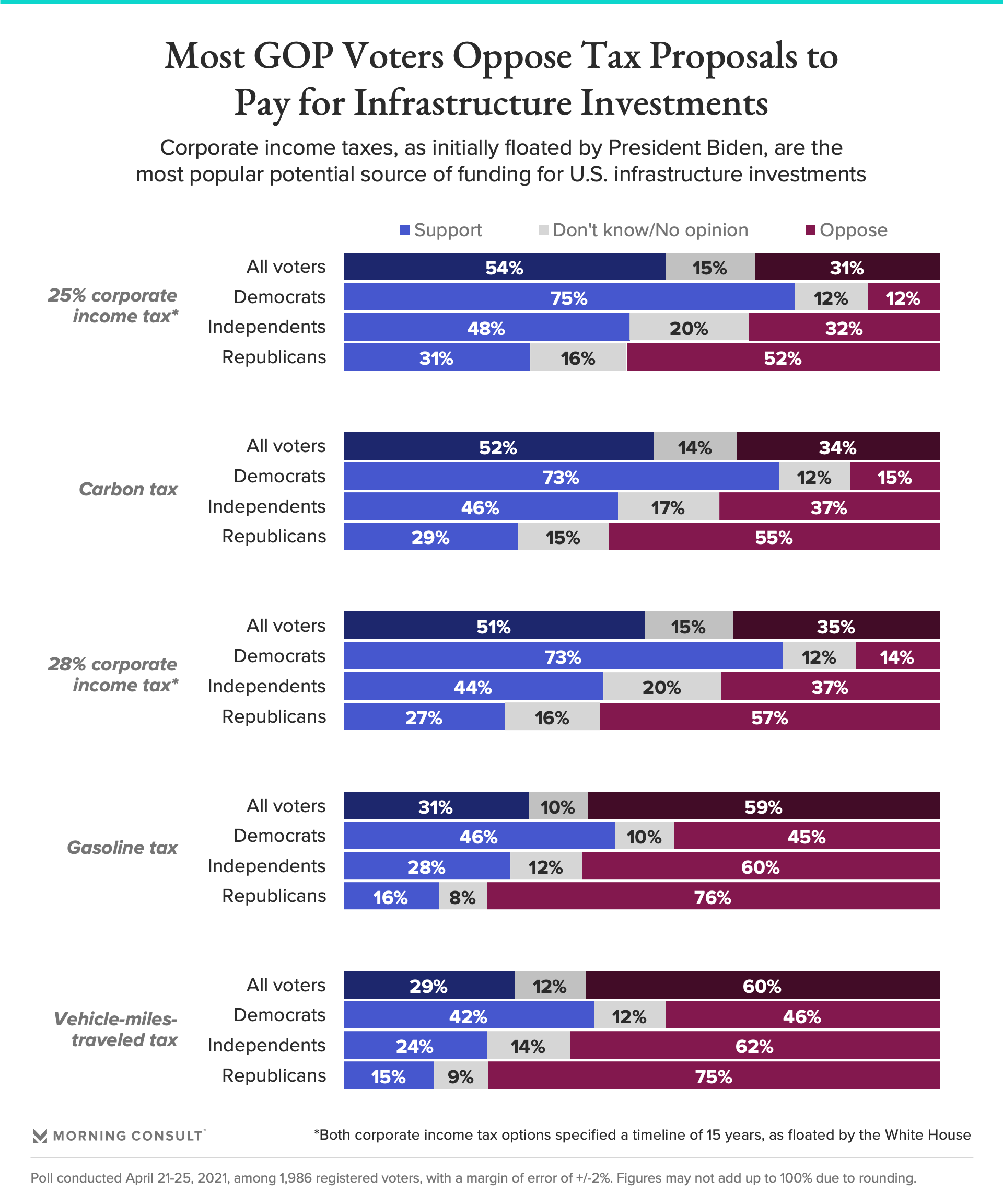

Voters Back Corporate Income Taxes Over Targeted Gas Mileage Taxes To Pay For Infrastructure Investments Morning Consult

West Virginia Economic Outlook 2021 2025 John Chambers College Of Business And Economics West Virginia University

9 Investigates North Carolina Testing Mileage Tax By Tracking Drivers Wsoc Tv

Everything You Need To Know About How A Reddit Group Blew Up Gamestop S Stock Cnn

A Mileage Tax No Biden S Bill Doesn T Impose New Driving Tax Snopes Com

Amazon Com Yolink Outdoor Security Siren Smart Alarm Controller Kit Loud 110 Db Wireless Battery Powered 1 4 Mile Range Android Ios App Alexa Google Ifttt Home Assistant Hub Required Cds Vinyl

Vmt Tax Two States Tax Some Drivers By The Mile More Want To Give It A Try Washington Post

The Absolute Best Doordash Tips From Reddit Everlance

How To Use Reddit For Business In 2022

California Prop 30 Income Tax For Electric Vehicles Calmatters

How To Use Reddit For Business In 2022

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek